About Us

At ORVEKA Prime Ventures LLP, we strive to make your dream home become reality.

We are motivated to make you feel happy while getting the possession of the flat and smiling through the process 😊

Explore Our Services

Features

Cons of Going Solo In House Purchase

- Clarity of needs missing.

- Your precious time and energy is wasted by inspecting unsuitable properties.

- You may get mesmerised by developer’s marketing tactics.

- You may end up paying more to the seller.

- You are left to your own mercy if transaction does not proceed the way it was supposed to be.

- Your professional work takes a backseat It leaves you confused and anxious.

- You may just postpone your purchase.

Our Process

We are a process driven organization which believes in excellence and client centricity at every step.

Features

Why Choose Us?

3 Reasons To Trust ORVEKA Prime Ventures LLP for Your Dream Home or Financial Planning.

- Client Centricity : Your needs / goals are our priority. We always believe that, it’s your journey towards your dream home or financially secured future and we are here to facilitate / guide.

- Transparency : We conduct all our deliverables with utmost transparency.

- Professionalism: We believe in highest degree of professionalism in all aspects of our business.

Features

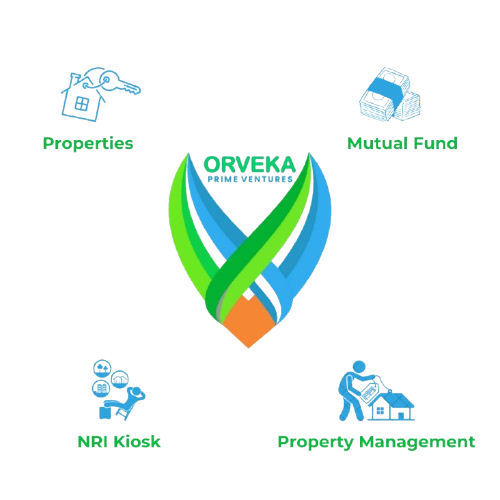

Our Goal Is To Provide You Best Solution With Your Investment

We know how to deliver the top investment advice service in town with the goal of meeting your future needs. See what other special offers we have available.

- Property

- Mutual Fund

- NRI Kiosk

- Property Management

Testimonials

What Our Clients Say About Us

We have a genuine customer base for our services and we are grateful to receive their feedback on our service.

Fully dedicated to finding the Best solutions.

Frequently Asked Questions

Buying or investing in real estate can bring many questions, especially in a dynamic market like Mumbai. To help you make confident and well-informed decisions, we’ve compiled a list of the most commonly asked queries by home buyers, investors, and NRIs. From understanding essential documents and loan eligibility to knowing the difference between ready-possession and under-construction projects, these FAQs cover every important aspect of property purchase.

What documents do I need to buy a property in India?

You typically need:

PAN Card

Aadhaar Card

Address proof

Income proof (salary slips/ITR)

Bank statements (6 months)

Passport-size photos

For resale properties: Sale deed, society NOC, electricity bill, tax receipt, and previous chain of documents.

What is the difference between Carpet Area, Built-up Area, and Super Built-up Area?

Carpet Area: Actual usable area inside the walls.

Built-up Area: Carpet area + walls + balcony area.

Super Built-up Area: Built-up area + common amenities (lift, lobby, staircase).

Is buying an under-construction property safe?

Yes, if the project is RERA registered. RERA ensures:

✔ Timely delivery

✔ Financial transparency

✔ Builder accountability

Always verify the RERA number before booking.

How much loan can I get while buying a property?

Banks typically provide 70%–90% of the property value depending on:

Your income

CIBIL score

Age

Employment type

Property valuation